Easily Access Medical Care Abroad

Air Doctor connects travelers to private doctors worldwide. From Germany to New York, we can help you find a doctor.

Need a doctor to rely on in the crowded streets of London or on the stunning beaches of Bali?

Air Doctor makes medical care abroad easy.

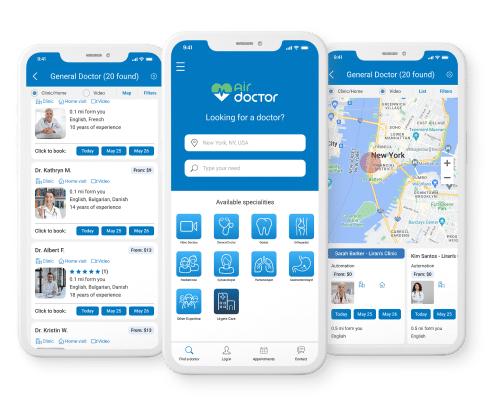

Global network of local doctors and specialists

Doctors who speak your language

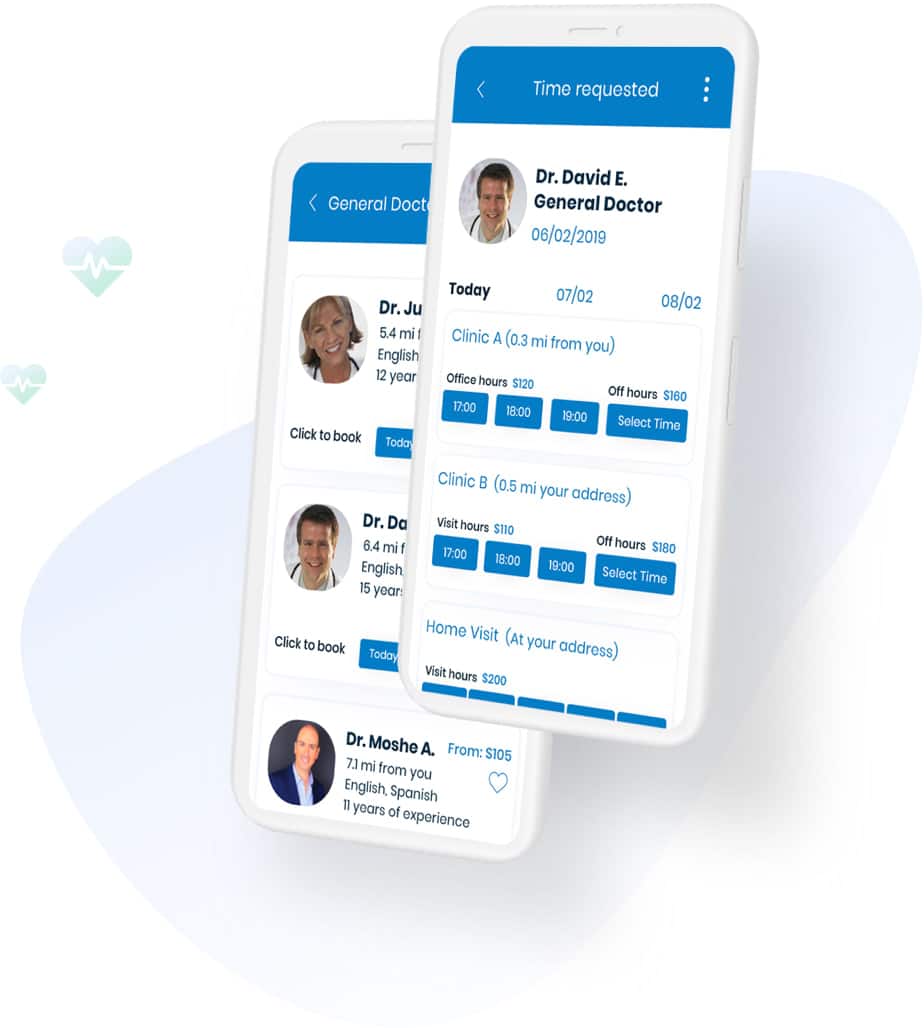

Book an in-person or online doctor visit in minutes

Home, clinic and telemedicine visits

Doctors checked and verified by us

Partner with Air Doctor

Partner with Air Doctor if you are looking to offer an online customer solution.

We provide a demonstrated digital health product that is a market differentiator.

Air Doctor helps partners:

- Boost customer satisfaction

- Build customer loyalty

- Increase revenue and market share

- Be an industry leader through innovation

Awards

For doctors

List your practice for free on the Air Doctor digital health app, and reach thousands of potential patients looking for medical care abroad.

- Attract and engage private patients

- Enjoy a streamlined payment process

- Expand and strengthen your online presence

Why Air Doctor

Testimonials

“Excellent and professional medical referral and emergency services. So reassuring to know there are professionals who care for you in a time of need.”

LONA SUARK

“I would like to thank all those engaged in your work. From the girl who answered me when I called to ask for help, when I really didn’t feel well, and to the person who treated me here.

I appreciate the show in interest and accompanying guidance on how and what to do, and of course for the refund that was sent to me in just a day.”

PEARL B.

Get the Air Doctor app

Download the Air Doctor app to receive prescriptions and medical care abroad 24/7.

Let us help you find a doctor in your immediate area or schedule an online visit.

- Browse specialized doctors around you

- Book appointments with a few easy taps

- Recover quickly and confidently, knowing that we are with you

Air Doctor in the news

Air Doctor appoints new Deputy CEO

Telemedicine firm Air Doctor has appointed Michal Kwiecinski as its Deputy CEO and Chief Business Officer

International Women’s Day: 7 FinTech companies with women founders

In celebration of International Women’s Day, FinTech Global is shining a spotlight on seven FinTech companies with woman founders.

Why InsurTechs need to focus on the customer experience

In today’s business landscape, prioritising the customer experience (CX) has become a ubiquitous concern across all industries. In the InsurTech realm, competition is intensifying, and insurance providers are increasingly recognising the pivotal role of the CX in attracting and retaining clients. FinTech Global recently sat down with a pair of industry experts to dissect this phenomenon.